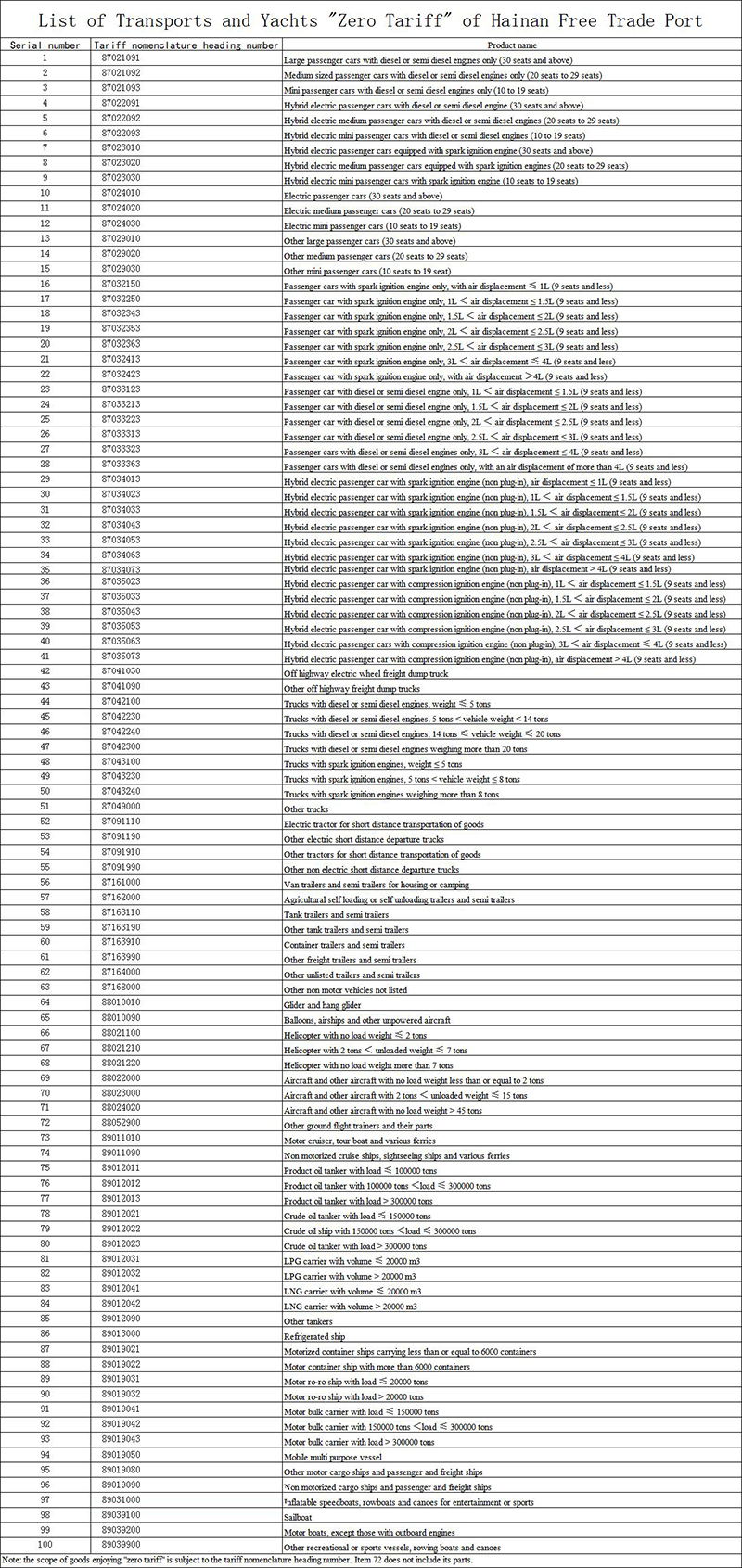

On December 25, with the consent of the State Council, the Ministry of Finance, the General Administration of Customs and the State Administration of Taxation jointly issued the Notice on “Zero Tariff” Policy for Means of Transport and Yachts of Hainan Free Trade Port, and issued the List of “Zero Tariff” Means of Transport and Yachts of Hainan FTP, including 100 items with 8-digit tax number such as passenger cars, caravans, airplanes, balloons, airships, yachts and sailboats. The implementation period shall be from the date of promulgation to the island-wide independent customs operations of the Hainan Free Trade Port.

After the implementation of the “zero tariff” policy, the purchase and operation costs of the listed goods will be greatly reduced. Take yacht as an example, if you buy yachts in other parts of China, you have to bear about the tariff of 38% of prices and import linkage tax. Nearly 3.8 million yuan in taxes and fees can be saved while importing a 10-million-yuan yacht in Hainan.

Policy Q & A

What qualifications do enterprises need for them to be eligible for “zero tariff” policy?

1.Enterprises registered in Hainan Free Trade Port.

2.With independent legal personality.

3.Engaged in transportation and tourism (Aviation enterprises shall take Hainan Free Trade Port as the main operating base.) .

What are benefits of “zero tariff” policy?

Ships, aircraft, vehicles, other means of transport and yachts imported to the island for transportation and tourism shall be exempted from import tariff, import value-added tax and consumption tax.

How to identify the subject qualification of “zero tariff”?

1. List management. After the enterprises apply in accordance with the provisions and are confirmed to be included in the list of enterprises eligible for the conditions of the policy, they will be automatically eligible for the “zero tariff” policy at the time of import customs clearance.

2. Provincial jurisdiction. Hainan Provincial Transportation, Cultural Tourism, Market Supervision, Maritime Administration and CAAC Central and Southern Regional Administration, together with Hainan Provincial Department of Finance, Haikou Customs, Hainan Provincial Taxation Bureau of State Administration of Taxation, will determine the list of enterprises eligible for the preferential policy and share them with Haikou Customs and Hainan social management information platform through the Information Sharing and Exchange Platform for Provincial Government Affairs.

3. Dynamic adjustment. Subject qualification can be applied at any time, and the examination and confirmation conditions of enterprise list shall be dynamically adjusted according to the adjustment of entries of transportation and tourism related industries in the catalogue of encouraged industries of Hainan Free Trade Port.

How to implement “zero tariff” policy?

1. List management. The “zero tariff” policy is only for the goods listed in the List of "Zero Tariff" Means of Transport and Yachts of Hainan Free Trade Port.

2. Dynamic adjustment. The list shall be dynamically adjusted by the Ministry of Finance, the General Administration of Customs and the General Administration of Taxation in conjunction with relevant departments.

How to manage “zero tariff” goods?

These goods should be registered and naturalized in Hainan Free Trade Port, operated in accordance with the relevant provisions of the competent authorities, and supervised by relevant departments.

1. Aircraft and ships: Both domestic and foreign routes are allowed, but they must depart from or stop at Hainan Free Trade Port.

2. Yacht: The business scope covers the whole Hainan Province.

3. Vehicles: Passenger and freight transport operations can be not only in Hainan Island, but also to and from the mainland. For transportation operations to and from the mainland, at least one end of the origin and destination should be in Hainan Free Trade Port.

How to manage vehicles travelling to and from the mainland?

If the “zero tariff” vehicles travelling to and from the mainland belong to the “point-to-point” and “immediately return” categories, the duration of stay in the mainland is not limited; For those which do not belong to “point-to-point” or “immediately return” mode, the accumulated stay in the mainland shall not exceed 120 days per year.

“Point to point” and “immediately return” refer to the mode of transportation of carrying out passenger and cargo transportation services in the mainland that starts from Hainan Free Trade Port, with relatively fixed place of stay and driving route, and returns immediately after loading and unloading passengers and goods.

Can “zero tariff” goods be transferred?

In principle, these goods cannot be transferred; If the transfer is really necessary due to the bankruptcy of the enterprise, the consent of the customs shall be obtained and relevant procedures shall be carried out before the transfer.

At the time of transfer, domestic value-added tax and consumption tax should be collected according to relevant regulations.

If these goods are transferred to the subjects who are not eligible for the policy, the enterprises shall pay the import related taxes according to the regulations.

How to supervise “zero tariff” goods?

The relevant departments of Hainan Province will issue the Measures for the Administration of “Zero Tariff” Means of Transport and Yachts in Hainan Free Trade Port, to further clarify how to determine the qualified enterprises, how to handle the registration and operation procedures of means of transport and yachts, and how to identify the special circumstances during operation, collect information through the Hainan Social Management Information Platform, and share the data through the Information Sharing and Exchange Platform for Provincial Government Affairs.

The full text of the notice and list is as follows

Notice on the “Zero Tariff” Policy for Means of Transport and Yachts of Hainan Free Trade Port

No. 54 [2020] of the Ministry of Finance

The Department of Finance of Hainan Province, the Haikou Customs District, and the Hainan Provincial Tax Service of the State Taxation Administration:

For the purpose of implementing the Master Plan for the Construction of Hainan Free Trade Port, with the approval of the State Council, you are hereby notified of the “zero tariff” policy for means of transport and yachts in Hainan Free Trade Port as follows:

1. Before the Island-wide independent customs operations, the ships, aircrafts, vehicles and other means of transport and yachts for operation services imported for transportation and tourism by enterprises engaging in transportation and tourism registered in Hainan Free Trade Port and with independent legal person status (aviation enterprises shall take Hainan Free Trade Port as the main operating base) shall be exempt from import tariffs, import value-added tax (“VAT”) and consumption tax.

The list of enterprises eligible for the policy shall be determined by the departments of transport, culture and tourism, market regulation, and maritime affairs of Hainan Province and the CAAC Central and Southern Regional Administration, among others, in conjunction with the Department of Finance of Hainan Province, the Haikou Customs District, and the Hainan Provincial Tax Service of the State Taxation Administration by reference to the industry items relating to transportation and tourism in the Catalogue of Encouraged Industries in Hainan Free Trade Port, and be subject to dynamic adjustments.

2. Means of transport and yachts eligible for the “zero tariff” policy are subject to positive list management. See the annex for the specific scope. The list shall be dynamically adjusted by the Ministry of Finance, the General Administration of Customs and the State Administration of Taxation together with relevant departments according to the actual needs and supervision conditions of Hainan.

3. “Zero tariff” means of transports and yachts are only for qualified enterprises’ own use in Hainan FTP and are subject to customs supervision. If the transfer is really necessary due to the enterprise bankruptcy, the consent of the customs shall be obtained and relevant procedures shall be handled before the transfer. When the means of transports and yachts are transferred to the enterprises which is not eligible for “zero tariff” policy, import tax which was exempted shall be made up. Domestic value-added tax and consumption tax shall be levied according to relevant regulations.

4. Enterprises that voluntarily pay import value-added tax and consumption tax for the means of transport and yachts can apply during customs declaration.

5. “Zero tariff” means of transport and yachts shall be registered in Hainan Free Trade Port, and shall be operated in accordance with the relevant regulations of the competent departments of transportation, civil aviation, maritime affairs, etc., and shall be subject to supervision. Aircraft and ships shall be operated in the domestic and foreign routes starting from or stopping at Hainan Free Trade Port. The operation range of yachts should be within Hainan Province. Vehicles can be used for transporting passenger & cargo to and from the mainland. At least one end of starting place and destination of the vehicles shall be the Hainan Free Trade Port, and the accumulated stay in the mainland shall not exceed 120 days per year. The duration of stay of “point-to-point” and “immediately return” passengers and trucks from Hainan Free Trade Port to the mainland shall not be limited.

In case of violation of the above provisions, the relevant import duties shall be made up correspondingly.

6. Hainan Provincial Departments of Commerce, Transportation, Civil Aviation, Finance, Customs, Taxation, etc. have formulated the Measures for the Administration of “Zero Tariff” Means of Transport and Yachts of Hainan FTP to clarify the procedures for determining the list of enterprises eligible for the policy conditions, the regulations on registration, naturalization, operation and supervision of “zero tariff” means of transport and yachts after import, the identification standard of aircraft and ship operation starting from Hainan Free Trade Port or domestic and international routes that have been stopped at Hainan Free Trade Port, the applicable situations and calculation method of vehicles staying in the mainland for an accumulative period of no more than 120 days a year, the identification standards, the identification departments and management requirements of “point-to-point” and “immediately return” transportation services, and the handling measures for violation of relevant provisions.

7. Relevant departments of Hainan Province should strengthen supervision, prevent and control risks, investigate and deal with violations in a timely manner, ensure the smooth operation of the “zero tariff” policy for means of transport and yachts, strengthen the information interconnection among competent departments in Hainan Province, and share the information on enterprises eligible for policy conditions and supervision of “zero tariff” means of transport and yachts.

8. This notice shall come into effect as of the date of promulgation.

Annex: List of “Zero Tariff” Means of Transport and Yachts of Hainan Free Trade Port

Ministry of Finance, General Administration of Customs, and General Administration of Taxation

December 25, 2020

Hainan Marine Trade Exchange Service Center:

Hainan Marine Trade Exchange Service Center: Sanya International Yachting Center:

Sanya International Yachting Center: Phone:+86 898 88222388

Phone:+86 898 88222388 Email:hnmteshr@163.com

Email:hnmteshr@163.com